Apart From Cbex, See Other Ponzi Schemes That Have Swindled Nigerians In The Last 5 Years.

You’ll agree that Nigeria is a country full of opportunities. However, some opportunities have been taken advantage of by fraudsters. Every day, people wake up to hear of one Ponzi scheme or the other.

Oftentimes, these fraudulent activities take centre stage on the internet. You easily hear of one scheme ripping an innocent individual. Here’s how you can legitmately make money online without being scammed.

Other times, it can happen when the site of a trusted scheme fails to load, like Cbex. Ponzi scheme scammers in Nigeria adopt different tactics.

In this article, we’ll focus on the different Ponzi schemes that have taken advantage of people in Nigeria for the last 5 years. Let’s get started with the most recent, Cbex!

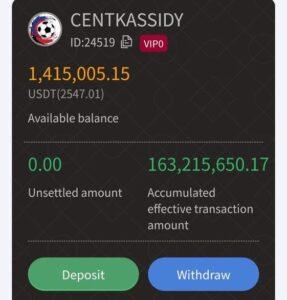

CBEX: The Cryptocurrency Circus.

Cbex burst onto the scene like a flashy magician. It promised unbelievable returns on cryptocurrency investments. “Invest now and become a millionaire by next week!” they claimed.

But, just like a magician’s rabbit, Cbex disappeared. Investors were left scratching their heads and wallets. “Did I think I could get rich quick?” many wondered. The only thing that grew was disappointment.

As quickly as it rose, Cbex crashed! Investors tried to withdraw their funds, but the site went dark. “Where’s my money?” became the battle cry of many.

The promises of quick riches turned to ashes. CBEX has now become a local term name in Nigeria, “bad market”. We heard the EFCC & INTERPOL are investigating to capture the people behind the Cbex platform.

MMM (Mavrodi Moneybox Mundial)

Ah, MMM. The classic Ponzi scheme made people cry literally. It promised participants a whopping 30% return every month. People flocked to it, dreaming of easy money. MMM had a familiar tune.

However, just like that band that can’t hit the high notes anymore, MMM crashed hard. Participants were left singing the blues, asking, “Where did my money go?”. Investors learned the hard way.

When MMM collapsed, many were left devastated. Some even turned to social media to vent their frustrations.

The fallout was massive. Trust in investment schemes went low. “Next time, I’ll stick to my savings account,” an X (formerly Twitter) user commented.

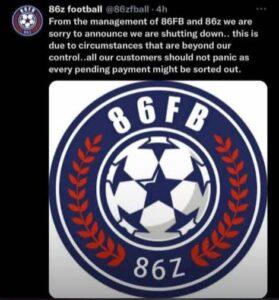

86FB: A Nigerian “Reverse Betting” Scam

In 2022, a football investment platform called 86FB took Nigeria by storm. They claim to partner with William Hill, a big-name UK gambling company.

It lured people in with an irresistible offer: make 3% daily returns (90% monthly!) just by following their “winning” betting strategies.

At first, it sounded like a dream come true. Who wouldn’t want easy, guaranteed profits? But as usual, if it seems too good to be true, it probably is.

How Did It Work?

86FB called itself a “reverse betting” platform, meaning investors supposedly earned money by following the site’s game picks. But in reality, it operated more like a Ponzi scheme, paying early investors with money from new victims.

To keep the scheme running, they needed fast, untraceable payments. Since most legal payment platforms would’ve shut them down, they secretly used Flutterwave, a legit Nigerian fintech company, to process transactions illegally.

The Inevitable Crash

Like all Ponzi schemes, 86FB couldn’t last forever. When new investors stopped pouring in, the payouts dried up, and people lost their money. Yet another “get-rich-quick” fantasy turned into a financial nightmare for many Nigerians.

Lesson learned? If a platform promises insane returns with zero risk, run the other way. I was a victim of the 86FB scam platform!

Twinkas Ponzi Schemes

Twinkas entered the arena with a sugary promise: double your money in no time! It was like a candy store for many investors. Everyone wanted a taste of that sweet deal.

Twinkas advertised itself as a way to make easy money. “Invest in Twinkas and watch your money grow!” they said. The promises were tempting.

People had already started envisioning vacations, cars, and new homes. Such a pity, I would say.

But soon, the candy turned to ash. When Twinkas collapsed, disappointment spread like wildfire. Social media buzzed with anger and disbelief.

“How could I be so gullible?” many asked themselves. The sweet promises turned bitter. Trust was shattered. “I’ll never fall for that again,” vowed countless individuals.

iCharity Club Ponzi Scheme

Next up was the iCharity Club, which claimed to combine charity with high returns. It sounded like a win-win! “Invest in charity, and you’ll get rich!” they said.

The concept was appealing. Who wouldn’t want to help others while making money? Investors felt good about their contributions.

“I’m doing good and getting rich!” they thought. But this generosity turned out to be a trap and a nightmare.

Many gave their money, hoping for returns. Instead, they learned that some charities are better left alone. When the iCharity Club collapsed, many felt betrayed.

They had invested in a dream that turned into a nightmare. The fallout left many questioning their judgment. “Next time, I’ll be more sceptical,” they promised.

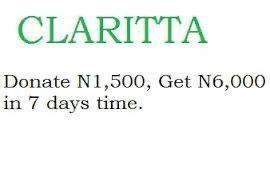

Claritta Dwindle Scheme

Claritta promised luxurious living and lavish returns. With flashy parties and glamorous ads, it drew in hopeful investors. The marketing was dazzling.

Claritta showcased a lifestyle of wealth and success. People were enamoured. In the twinkle of an eye, Clarita vanished, leaving many in shock.

When Claritta collapsed, the reality hit hard. Many found themselves in financial distress. “Where did all my money go?” became a common question.

The glamour faded, leaving only regret. “I should have known better,” many reflected. And yet, it never ends there, as many refused to be wise.

Looper’s Club: The Never-Ending Cycle

Looper’s Club entered the mix with a catchy name. It promised endless returns in a loop of investments. “Keep it going, and watch your money grow!” they advertised.

The idea was enticing. Participants felt they were part of an exclusive club. “Invest now and reap the rewards forever!” they were told.

But just like a hamster in a wheel, participants found themselves running in circles. The scheme collapsed, leaving many broke.

The collapse of Looper’s Club left many bewildered. The cycle of disappointment was unending. Many cried and wept, but still were not wise.

Conclusion

It is better to carefully vet before investing in any scheme. You can easily take advantage of Google or other artificial intelligence (AI) platforms to do careful research.

Even though one cannot be 100% safe, it is better to take the needed steps to confirm their legitimacy. Check their registered firm and who’s in charge of the business before investing.

This is Nigeria, and I know for sure, more Ponzi schemes will erupt, and many will still fall for their tricks and sweet offers.

It’s so unfortunate how many people waste money online, through blind so-called business investments. Which of these platforms were you a victim of? Share with us in the comment section!